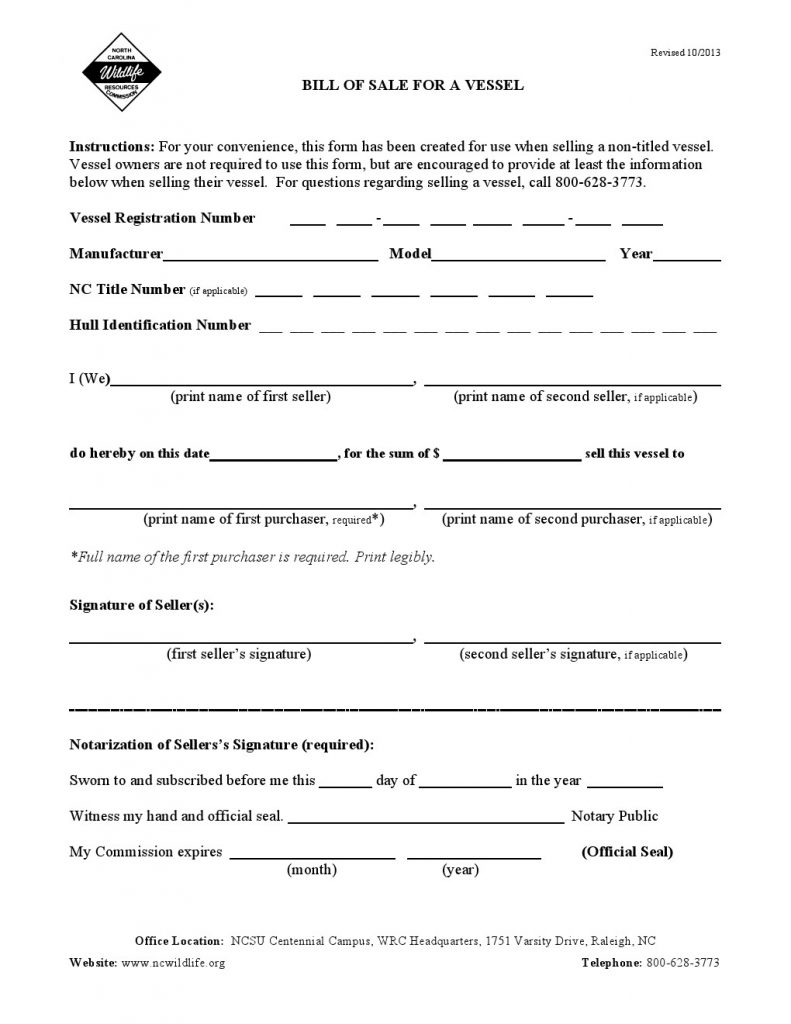

How long do I have to pay sales tax on my new purchase?ĥ0 Days from the date of purchase. To transfer the title, the title will have to. doc format and editing it in Microsoft Word or Google Drive. The buyer does not have to sign in front of a notary. If you need to make edits to the text of your document, you can do so by downloading it in. The state of Florida recommends getting the bill of sale notarized. The Florida Department of Highway Safety and Motor Vehicles (DHSMV) even provides an easy-to-use, state-approved bill of sale template. The transferee has 45 days to operate on a properly executed title. Oklahoma requires that the seller(s) signature be notarized. In Florida, a BoS is a mandatory requirement of the state in private party sales of vehicles. The title is to be dated and delivered to the transferee at the time of delivering the vehicle. A person can operate on notarized title when ownership transfers and the title is not held by a bank or other financial institution. How long can I drive on a notarized bill of sale or notarized title?Ī person can operate on notarized bill of sale for 60 days if the title is being held by a bank or other financial institution and the title is not available at the time the vehicle is delivered. Wyoming only honors an out of state temporary for 45 days regardless of where the temporary came from.Įx: South Dakota's Temporary is only good for 30 days, Wyoming will honor it for 45 days as long as you keep the vehicle inside Wyoming.Įx: Colorado's Temporary is good for 60 days, Wyoming will only honor 45 days and sales tax needs to be taken care of with in 50 days of purchase date. How many days do I have to drive on my temporary if I purchased my vehicle out of state? Updated on Table of Contents A bill of sale is not required in North Carolina for the sale of private vehicles, but it is considered best practice to document the transaction by drawing one up yourself and having it notarized. Payment online is NOT available at this time. We accept cash, money order, checks, and credit & debit cards (use of this service carries a 2.95% convenience fee, or a minimum of $2.00.

0 kommentar(er)

0 kommentar(er)